- IELTS WRITING TASK 1 - BAR GRAPH

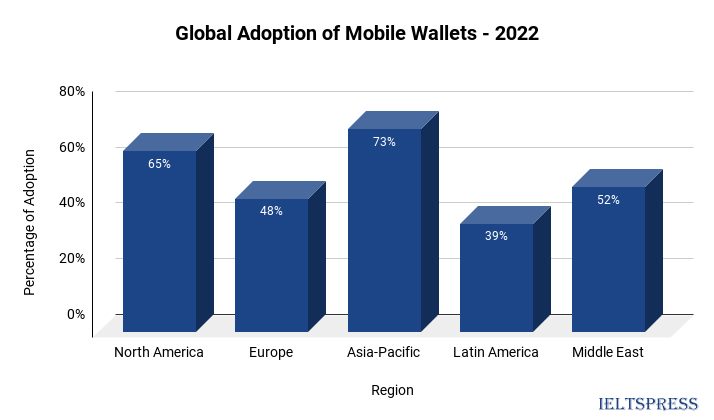

Global Adoption of Mobile Wallets – 2022

You should spend about 20 minutes on this task.

Task: The graph below presents data on the adoption of mobile wallets by participants across different regions globally in 2022. Summarize the information by selecting and reporting the main features, and make comparisons where relevant.

Write at least 150 words describing the main trends and comparisons shown in the graph.

Sample Answer, C1 English Level, Advanced, Band Score 6.5-7.5

The graph depicts the global adoption of mobile wallets across various regions in the year 2022. The data reveals varying levels of acceptance among different parts of the world. In North America, 65% of the population has embraced mobile wallets, indicating a significant inclination towards this modern payment method. Europe follows with 48% adoption, demonstrating a slightly lower but notable interest in using mobile wallets for transactions.

On the other hand, the Asia-Pacific region showcases the highest adoption rate at 73%, suggesting a strong preference for the convenience and efficiency of mobile wallet usage. Latin America displays a comparatively lower rate of adoption, standing at 39%, which could be attributed to factors like differing payment habits and infrastructure. Meanwhile, the Middle East reports a 52% adoption rate, marking moderate interest in mobile wallets in this region.

In summary, the graph highlights the global diversity in mobile wallet adoption, with Asia-Pacific leading the way and other regions showing varying levels of interest. It reflects the evolving payment landscape and the increasing importance of digital solutions in facilitating financial transactions worldwide.

The graph showcases the global adoption of mobile wallets in 2022 across different regions. It’s interesting to see the varying levels of acceptance in using this technology for transactions. In North America, 65% of people have embraced mobile wallets, indicating a significant preference for this convenient method. Europe follows suit with 48% adoption, showing a notable interest but slightly lower than North America.

The Asia-Pacific region stands out with the highest adoption rate at 73%, reflecting a strong inclination towards the convenience of mobile wallets. Latin America, on the other hand, has a lower adoption rate of 39%, possibly due to factors like traditional payment habits. The Middle East lies in between with a 52% adoption rate. This data sheds light on the shifting global payment landscape and how technology is reshaping how we handle transactions.

In summary, the graph demonstrates the diverse global adoption of mobile wallets, with Asia-Pacific leading in enthusiasm, North America and Europe showing keen interest, and Latin America and the Middle East adapting at their own paces. It’s a clear indicator of how technology is revolutionizing financial habits around the world.

The graph illustrates the global adoption of mobile wallets in the year 2022 across various regions. The data vividly displays the extent to which different parts of the world have embraced this modern payment method. North America demonstrates a significant acceptance rate, with 65% of individuals choosing mobile wallets for their transactions. Following closely, Europe shows a notable interest, though slightly lower at 48%.

Remarkably, the Asia-Pacific region leads the way with a remarkable 73% adoption rate, showcasing a robust enthusiasm for the convenience and efficiency offered by mobile wallets. In contrast, Latin America presents a relatively lower adoption rate of 39%, which may stem from cultural and economic factors influencing payment behaviors. The Middle East positions itself in between, with 52% adoption, indicating a moderate but steady adoption.

In essence, the graph paints a compelling picture of global financial trends, underscoring the dynamic nature of how technology is reshaping payment habits. While some regions display fervent embrace, others progress at their own pace. The data reflects the intricate interplay of culture, infrastructure, and technological innovation that collectively define the evolution of financial transactions on a global scale.